TIN Tax ID Number is so important that according to the law, only one TIN can be given to an individual. It has to be provided when you get a job as everyone with a job is entitled to pay taxes. Getting TIN used to be part of the responsibilities of the first company you are working in, but now many companies require their applicants to already have their TIN. Also you can get one of you are self-employed. There is no need to worry as you can now easily get yours through online BIR eReg.

If you are self-employed, make sue that you have a valid email add that you can provide. Be sure that you will be able to open your email account as the BIR will send your TIN and confirmation message in your email.

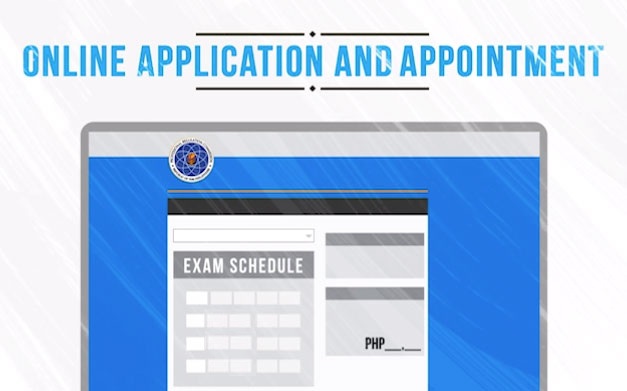

Visit the BIR eReg page and fill in the requested details. Make sure that the details you provide are all consistent with your other legal documents. They must be accurate. Do not forget to tye in the Captcha code as it will prove that you are a real person and not a computer generated spam. Before you click Submit, review the information one last time. After clicking the Submit button, check your email for the confirmation message from BIR containing your TIN. If you can’t find it in your Inbox, try looking in the spam messages.